The Buzz on P3 Accounting Llc

Wiki Article

Some Ideas on P3 Accounting Llc You Should Know

Table of ContentsThe 7-Minute Rule for P3 Accounting LlcSome Ideas on P3 Accounting Llc You Need To Know7 Simple Techniques For P3 Accounting LlcSome Ideas on P3 Accounting Llc You Need To KnowThe 8-Second Trick For P3 Accounting Llc

We have a group of over 200 specialists with diversified histories. We specialize in offering audit solutions to professional service organizations. We provide greater than two loads specialized industry technique teams with deep understanding and wide experience in these fields: Literary Providers; Agencies; Innovation, Net, Media and Amusement; Building; Production, Retailing and Distribution; Maritime, and Cost Partition Groups.By Kimberlee Leonard Updated March 04, 2019 Audit firms use a myriad of solutions that help company owner stay economically arranged, tax obligation compliant which help prepare for business development. Local business owner shouldn't consider an accounting company merely as an outsourcing expense for bookkeeping yet as an important organization companion.

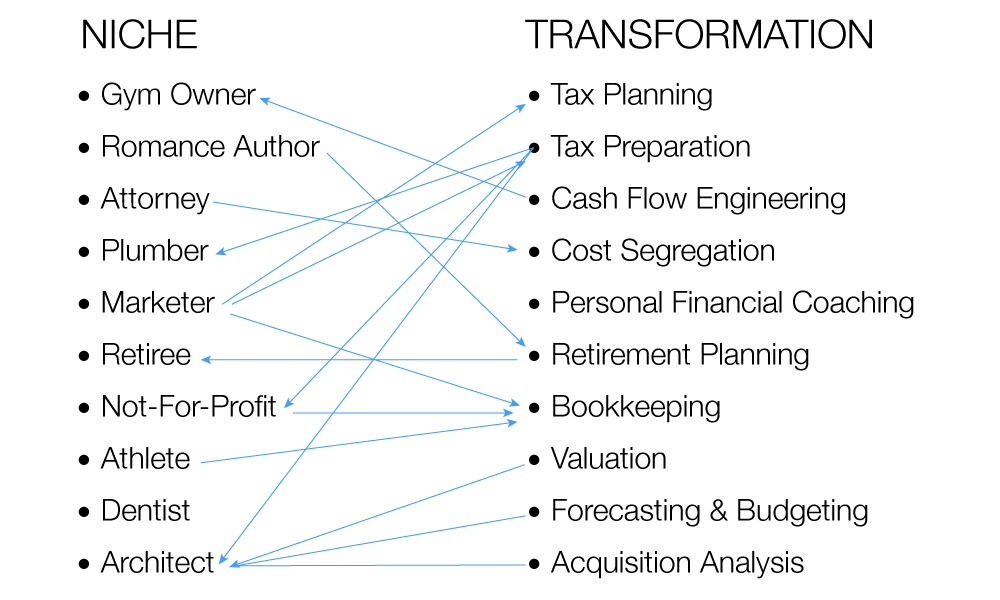

While some bookkeeping firms focus on niche services such as tax technique, many will certainly provide accounting and pay-roll solutions, tax preparation and organization assessment services. There is a lot even more to tax planning and prep work than finishing tax obligation returns, although bookkeeping companies prepare both state and federal business income tax return. Accounting companies additionally prepare year-end company files, such as internal revenue service owner K-1, worker W-2 and 1099-Misc forms.

Additionally, local business owner require to develop company entities that develop most favorable tax obligation situations. Bookkeeping firms help recognize the best remedies which aid in the development of entities that make the very best tax sense for the company. Some estate planning requirements are special to numerous company owner, and an accountancy company assists identify these.

The Best Guide To P3 Accounting Llc

Companies will collaborate with estate planning lawyers, financial organizers and insurance policy representatives to implement lasting methods for company transfers and to alleviate estate taxes. Several organization owners are terrific at giving the services or product that is the backbone of business. Company owners aren't always specialists at the monetary aspects of running an organization.Duplicates of business bank accounts can be sent out to bookkeeping firms that collaborate with bookkeepers to keep exact cash flow documents. Audit firms additionally develop revenue and loss declarations that damage down essential locations of expenses and income streams (https://www.pageorama.com/?p=p3accounting). Accountancy firms additionally might help with accounts receivable and handle outbound monies that include vendor repayments and pay-roll processing

Accountancy companies are essential when a business requires to produce valuation records or to acquire audits that financing firms need. When an organization looks for a loan or funding from a private financier, this purchase needs to be properly and properly valued. It is also needed for potential mergings or purchases.

Some audit firms likewise aid brand-new companies with pro forma economic declarations and estimates. OKC tax deductions. Pro forma financials are made use of for first financing or for service growth. Accounting companies make use of sector information, in addition to existing firm financial background, to compute the data

How P3 Accounting Llc can Save You Time, Stress, and Money.

The Big Four also offer electronic change consulting to serve the requirements of business in the electronic age. The "Big 4" refers to the four largest accounting firms in the U.S.The largest bookkeeping companies made use of to consist of the "Large 8" however mergers and closures have decreased the number of top rate business.

Arthur Young combined with Ernst & Whinney while Deloitte Haskin & Sells combined with Touche Ross to minimize the team count to six. Cost Waterhouse and Coopers & Lybrand merged their methods, making the overall 5.

The Ultimate Guide To P3 Accounting Llc

Big 4 customers include such business giants as Berkshire Hathaway, Ford Motor Co., Apple, Exxon Mobil, and Amazon., 30% of the S&P 500 he said were audited by Pw, C, 31% by EY, 20% by Deloitte, and 19% by KPMG.With 360-degree views of business and sectors, the Big Four are authorities in business. They have comprehensive recruiting and training programs for fresh grads and use valued avenues for tax and consulting professionals to and from numerous industrial sectors. Each Big 4 company is a make-up of specific expert solutions networks instead of a solitary company.

Regardless of general business development, Deloitte's 2021 United States profits decreased from 2020. In 2021, Pw, C reported annual profits of $45. 1 billion, the 2nd highest amount for Big 4 companies however only up 2% (in its neighborhood money) from the year prior. Revenue in the USA remained flat, though Pw, C is currently investing $12 billion to add 100,000 new jobs over the following 5 years to reinforce its international visibility.

Worldwide, Pw, C operates in 152 nations and its international workforce numbers 328,000 people. During 2021, Ernst & Youthful reported roughly $40 billion of company-wide profits, a boost of 7. 3% from the year prior. EY has actually taped 7. 3% compound yearly development over the past 7 years.

Report this wiki page